The buying and the renting worlds seem quite similar.

Think HomeCentre and Furlenco. A Hyundai showroom and ZoomCar. DLF and NestAway.

Both have the same inventory – furniture, vehicles, homes. Both target the same customers – those who seek access to these assets. Both take money – one immediately and the other in parts.

But that’s where the similarity ends.

While we, as customers, don’t think for a second before placing an order online for something we need, we are quite hesitant when it comes to renting.

In this article, we’ll help you appreciate the vastly different ecosystems the sellers and the rental players operate in and see how the two can be brought to par.

The difference in the ecosystems

Sellers have nothing to worry about in a transaction. They receive the money owed to them immediately.

It’s the banks that lend the users the money to make the purchase that have to live with some uncertainty, just like the players from whom we rent. Both the parties depend on the customers staying true to their word of making the payments on time.

Yet, we don’t see banks and rental players in the same light.

The banks enjoy endless support from all quarters – the regulatory authorities, credit bureaus, RBI etc. With this support & legal provisions, the banking system is always well-protected.

The banks also get to rely on a person’s credit rating that determines how likely he/she is to default. And that’s golden information. It helps a bank assess the creditworthiness of a borrower and make decisions accordingly.

On the other hand, the rental players are left in the dark about a customer’s ability to pay on time. They have no resources at hand to figure out users’ intention behind renting, their history of defaults or any information to assess whether they will use the product well, without damaging the asset.

Here’s a recent story. Despite providing the much-needed last-mile connectivity in a city like Bangalore, where the public transportation is far from adequate, bike rentals have suffered rampant vandalism, thefts and misuse.

The worst part is that even if the offenders were to go to a different rental company to rent another asset with the same intention, the new player will never know.

Given that the rental player is just another organisation trying to make lives simpler for the larger public, the whole deal seems quite unfair. The banks have multiple infrastructural elements to safeguard their interests. The rental players, for now, have none.

That way, rental players take a gamble each time they onboard a customer.

They operate on trusting their customers yet have no anchors to base it on, which is where the tragedy of the ecosystem lies.

The friction in renting

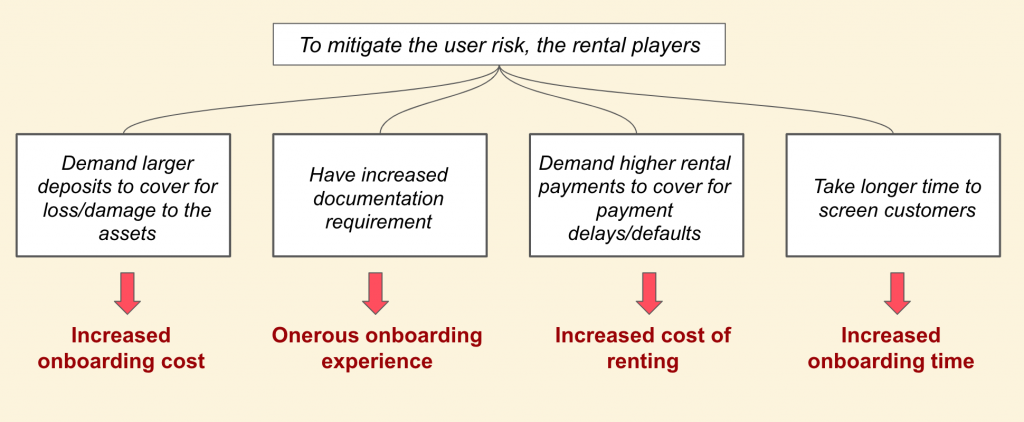

This trust deficit in rental players manifests itself in these forms:

All these mechanisms have simply increased the friction associated with renting an asset.

The friction coupled with the cost of experiencing rental services has thus become too high. Too high for renting to become the default choice of the customers.

The post-COVID opportunity

With COVID shrinking the disposable income of the public, there would be a definite shift in the consumption habits of the populace. In the new norm, people’s inclination to rent assets would definitely see an uptick. Yet, the rental players are in no position to take advantage of such a behaviour shift.

The only way for them to remove friction would be to get access to verified data about a customer that acts as a substitute for a credit score.

With the help of past data, obtained directly from the customer or from a peer, rental players should be able to assess a customer’s ability and intent to make payments on time and know how they would handle the rented asset.

This can help customers experience more services at a lower cost. All this without the provider having to mitigate its risk arising from wondering whether the user is a bad element in the ecosystem.

We have seen how cloud computing services such as AWS, Azure etc. have become the go-to choice for most people, all because of their ease of usage and cost friendliness. The renting players need to make sure the same is true for all physical assets as well.

The reduced cost of renting would encourage all good customers to become repeat renters. The process of collaboration & customer empowerment that aim to bring the rental players at par with the traditional sellers can unleash a new age – where renting any asset can become more cost-effective than buying, as it should be.

For both the parties, that’s quite the win-win. Tell us what you think.

0 Comments